- Revolox

- Posts

- Nasan Energies Set to Acquire 53 Engen and Shell Fuel Stations from Vivo Energy- ISSUE # 81 ☕

Nasan Energies Set to Acquire 53 Engen and Shell Fuel Stations from Vivo Energy- ISSUE # 81 ☕

Nasan Energies Namibia (Pty) Ltd has announced a landmark deal to acquire 53 fuel service stations branded Engen and Shell from Vivo Energy Namibia, pending approval from the Namibian Competition Commission

Revolox banner

Welcome to today’s edition of Revolox Media – where Namibia’s resource developments meet global shifts in energy and technology.

Oscillate PLC has expanded its footprint with the acquisition of major copper assets in Namibia and Botswana, reinforcing Southern Africa’s role in global minerals supply. In the energy sector, Nasan Energies is set to acquire 53 Engen and Shell fuel stations from Vivo Energy, a deal that signals stronger local participation in downstream petroleum.

Globally, Taiwan plans to double its chip and electronics exports to India, fueled by rising smartphone shipments and deepening tech partnerships. Meanwhile, Microsoft has blocked an Israeli military unit’s access to its cloud and AI services amid a surveillance probe, raising new debates on corporate accountability in sensitive technologies.

Stay informed with Revolox Media — connecting Namibia to the world. ✨

MARKET CORNER

Index

Index | Price | % Change | YoY % Change | YTD % Change |

|---|---|---|---|---|

NSX Overall | 1,904.66 | 0.33% | 0.80% | 5.75% |

NSX Local | 757.52 | 0.03% | 10.95% | 9.58% |

Top Movers: NSX Local Stocks

Stock | Price (N$) | % Change | YoY % Change | YTD % Change | Volume (Shares Traded) |

|---|---|---|---|---|---|

Letshego Holdings Namibia Ltd | 6.55 | 0.00% | 41.77% | 31.00% | 0 |

Capricorn Group Ltd | 22.20 | 0.09% | 13.50% | 7.87% | 0 |

Standard Bank Namibia | 11.26 | 0.09% | 24.83% | 24.01% | 0 |

Nictus Holdings | 2.90 | 0.00% | 30.63% | 16.00% | 0 |

FirstRand Namibia | 52.01 | -0.02% | 11.97% | 11.85% | 0 |

Economic Pulse

Indicator | Value | Percentage % | Change (YoY) |

|---|---|---|---|

Real GDP (Dec 24) | 157,476.47M | 3.71% | 3.71% |

Nominal GDP (Dec 24) | 245,097.32M | 7.08% | 7.08% |

Inflation (Jun 25) | 3.66% | 5.79% | -21.12% |

Private Sector Credit Extension (May 25) | 119,330.60M | 0.54% | -2.25% |

Namibian Repo Rate (Jun 25) | 6.75% | 0.00% | -12.90% |

Foreign Exchange Rates

Currency Pair | Value | % Change | YoY % Change |

|---|---|---|---|

USD/ZAR | 17.46 | 1.19% | 1.09% |

GBP/ZAR | 23.28 | -0.13% | 1.21% |

EUR/ZAR | 20.36 | -0.09% | 5.88% |

BTC/NAD | 2,109,239.15 | 1.52% | 69.80% |

Disclaimer: The financial data and market information provided in the tables below, including stock prices, indices, exchange rates, economic indicators, and other metrics, are sourced from user-provided data and are accurate as of 26 September 2025 based on the latest input. This information is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell securities. Market data is subject to change, and past performance is not indicative of future results. Users should verify data independently and consult with a qualified financial advisor before making investment decisions. Revolox will not be responsible for any errors, omissions, or losses arising from the use of this information.

BUSINESS & ECONOMY

Image credit: BusinessExpress

Oscillate PLC Expands Acquisition, Secures Major Copper Assets in Namibia and Botswana

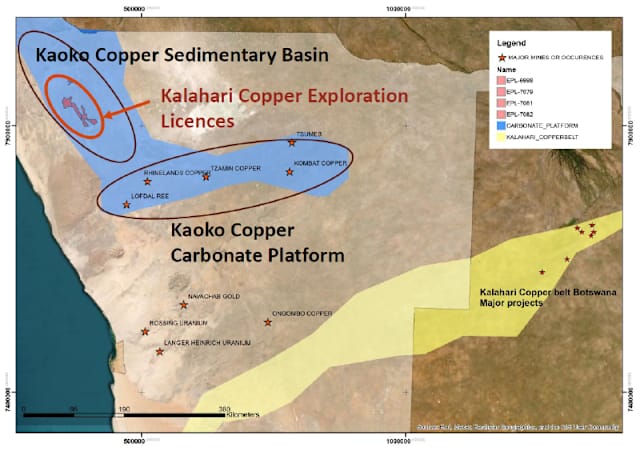

Oscillate PLC has revised and expanded its acquisition agreement for Kalahari Copper Limited, now encompassing significant copper assets in Namibia alongside the previously announced Botswanan portfolio.

Key Highlights:

Expanded Deal Scope:

Oscillate gains pathway to 100% ownership of Kalahari’s Namibian Copper Project.

Namibian project covers four licenses totaling 1,106 km² in the Kaoko Basin, establishing Oscillate as a leading acreage holder in the region.

The Botswanan portfolio includes 17 licenses in the prolific Kalahari Copper Belt and Bushman Lineament, near active major mines.

Exploration Progress and Potential:

Namibian assets have undergone over 8,000 meters of drilling.

2024 drilling has returned multiple high-grade copper intersections with grades from 1.1% to 1.9%, indicating strong mineralization.

Revised Financial Terms:

Oscillate will issue shares equivalent to 30% of its outstanding ordinary shares on signing the share purchase agreement.

Cash payment increased to £2.0 million (from £1.5 million), payable within 10 business days after relisting on a senior exchange.

Additional milestone payments of £1.5 million each upon hitting key development stages for both projects.

Seller to receive a 1.9% net smelter royalty on copper production from any licenses.

Seller granted options for up to 6% of Oscillate’s capital post-flotation.

Next Steps and Conditions:

Exclusivity period runs until October 31, 2025.

Completion depends on due diligence outcomes, regulatory approvals, and customary conditions.

The Bottom Line:

Oscillate’s expanded acquisition of Kalahari Copper assets significantly boosts its strategic footprint in Southern Africa’s copper-rich frontiers. With proven copper mineralization and substantial license holdings in Namibia and Botswana, the deal positions Oscillate for substantial growth potential in one of the continent’s most promising mining regions. Successful completion will enhance Oscillate’s portfolio and attractiveness ahead of its planned senior exchange listing.

Source: BusinessExpress

Image credit: BusinessExpress

Nasan Energies Set to Acquire 53 Engen and Shell Fuel Stations from Vivo Energy

Nasan Energies Namibia (Pty) Ltd has announced a landmark deal to acquire 53 fuel service stations branded Engen and Shell from Vivo Energy Namibia, pending approval from the Namibian Competition Commission. This deal marks a significant milestone for local ownership in Namibia’s energy sector.

Key Highlights:

Background and Regulatory Conditions:

Vivo Energy acquired Engen Namibia from Petronas in May 2024.

As part of regulatory conditions, the Namibian Competition Commission required Vivo Energy to divest several service stations to maintain competitive market dynamics.

Following an evaluation of technical and financial proposals, Nasan Energies was selected as the preferred bidder.

Local Ownership and Empowerment:

Nasan Energies will emerge as one of the first major locally owned oil marketing companies (OMCs) in Namibia.

The founders emphasize alignment with the government’s call for greater local ownership to drive job creation and economic empowerment.

Miguel Hamutenya, one of Nasan’s founders, expressed commitment to contributing to Namibia’s resource empowerment.

Company Heritage and Values:

The name ‘Nasan’ combines “Na” for Namibia and “San” referencing the Khoisan culture, symbolizing resilience, adaptability, and a deep connection to Namibian roots.

Co-founder Shiraz Tobias underscored the company’s ethos reflecting these cultural strengths.

Leadership and Expertise:

The leadership team brings extensive downstream petroleum, fuel retail, and distribution experience.

Senior advisor Jean-Blaise Ollomo offers over 30 years of industry expertise.

Co-founder Sean Tobias highlighted the importance of supporting local entities for sustainable employment and leadership in the sector.

Market Position and Future Plans:

The acquisition positions Nasan as the third-largest fuel retailer in Namibia by number of sites, following Vivo Energy and Puma Energy.

Plans include maintaining financial discipline and building strong brand equity to support growth.

Vivo Energy’s Role:

Vivo Energy Namibia’s Managing Director, Jaco Van Rensburg, welcomed the agreement, emphasizing the deal’s role in preserving competition and providing clarity for dealers and partners during the transition.

The Bottom Line:

The acquisition by Nasan Energies marks a transformative moment in Namibia’s energy sector, elevating local ownership while reshaping a market traditionally dominated by multinationals. With a strong leadership team, cultural roots, and strategic ambitions, Nasan Energies is poised to become a leading player in Namibia’s retail fuel landscape, contributing to job creation, empowerment, and economic growth. The transaction underscores the critical role of local participation in sustainable national resource development.

Source: BusinessExpress

TECH

Image credit: Reuters

Taiwan to Double Chip and Electronics Exports to India Amid Rising Smartphone Shipments

Taiwanese trade officials have revealed plans to double exports of chips and electronic goods to India within the next five to seven years, driven in large part by soaring Indian smartphone shipments to the United States.

Key Highlights:

Trade Growth:

Taiwan’s exports to India topped $10 billion in 2024, more than doubling in five years from about $4 billion.

The exports are primarily chips, electronic components, and machinery.

Smartphone Manufacturing Surge:

Indian smartphone exports to the US surged nearly 40% year-on-year in the first five months of fiscal 2026 to $8.43 billion, boosted largely by demand for Apple’s iPhones.

India overtook China as the leading smartphone exporter to the US in Q2 2025, with made-in-India phones accounting for 44% of imports versus China’s declining 25%.

Apple expanded iPhone manufacturing in India significantly, crossing 20 million units exported in H1 2025.

Strategic Investments:

Taiwanese firms have invested approximately $5 billion in Indian manufacturing.

Powerchip Semiconductor and Tata Electronics launched an $11 billion AI-powered chip plant in Gujarat.

Foxconn committed $1.5 billion to expand its India operations, shifting production away from tariff-impacted China.

Trade Relations and Future Outlook:

Taiwan-India trade relations remain strong despite US tariffs on Indian goods.

Officials highlight India’s large domestic market and growth opportunities in petrochemicals, textiles, and electronics.

Taiwan aims to build stronger supply chains with local investments, supporting broader regional growth.

The Bottom Line:

Taiwan’s ambition to double chip and electronics exports to India aligns with India’s rapid rise as a global smartphone manufacturing hub, led by major multinationals like Apple. The dynamic trade relationship reflects shifting global supply chains driven by market demand, geopolitical factors, and strategic investments. This growth trajectory signals continued deepening of commercial ties between Taiwan and India, with significant implications for technology supply chains and regional economic development.

Source: Reuters

Image credit: GeekWire

Microsoft Blocks Israeli Military Unit’s Access to Cloud and AI Services Amid Surveillance Probe

Microsoft has halted some of its technology services to an Israeli military intelligence unit following internal findings that corroborate reports of mass surveillance on Palestinian civilians.

Key Highlights:

Action Taken:

Microsoft disabled specific Azure cloud storage and AI services used by Unit 8200, an elite cyber warfare division within Israel’s Ministry of Defense.

The move follows an investigation by The Guardian, +972 Magazine, and Local Call revealing the unit’s use of Microsoft Azure for processing millions of intercepted phone calls of Palestinians in Gaza and the West Bank.

Internal Review Results:

Microsoft’s review found evidence supporting media reports, including extensive consumption of Azure services in the Netherlands and application of AI tools.

The company emphasized it does not supply technology for mass civilian surveillance and adheres to strict service terms.

Microsoft stated it has not accessed customer content during the review, focusing on its own business records and contracts.

Company Statement:

Brad Smith, Microsoft President and Vice Chair, highlighted the company’s commitment to human rights and privacy, stating the decision aligns with long-standing principles.

The termination of services to Unit 8200 does not affect Microsoft’s broader cybersecurity services to Israel and other Middle Eastern countries.

Reactions and Protests:

The revelations have sparked protests including at Microsoft’s headquarters, led by groups demanding a severance of ties with the Israeli military.

Activists view Microsoft’s actions as a partial victory stemming from sustained pressure.

Surveillance Scale:

The reported surveillance involved storing up to 8,000 terabytes of phone call data daily, which was later reportedly moved to another cloud platform to circumvent restrictions.

The Bottom Line:

Microsoft’s decision to block certain services to Israel’s Unit 8200 marks a significant step in addressing concerns over technology’s role in mass surveillance of civilians. While maintaining critical cybersecurity partnerships, Microsoft is navigating the ethical and operational challenges of ensuring compliance with privacy principles amidst complex geopolitical pressures. The move underscores growing scrutiny over tech giants’ involvement in military intelligence operations worldwide.

Source: GeekWire

PERSONAL DEVELOPMENT

“Friday is the reward for your hustle—pause, reflect, and recharge for what’s ahead.”

✨You’ve earned this moment. Celebrate progress, no matter how small. 🌿 #FridayMotivation #RevoloxMindset"

Reply